In 2016, the average tax revenue as a percentage of gross domestic product (GDP) was 26.15 percent for OECD countries, but only 15.47 percent for Sub-Saharan Africa (SSA). Some scholars attribute SSA countries’ weak tax capacity to administrative and technical challenges, their large informal sector, and colonial legacies (Burgess & Stern, 1993; Mkandawire, 2010). Others acknowledge that political bargaining between actors over the design and implementation of fiscal contracts and government’s responsiveness equally shape a state’s ability to tax (Levi, 1988; Prichard, 2015). Our recent paper (Aboagye & Hillbom, 2020) explores how the relationship between politics and taxation has historically played out in Ghana.

Fiscal Capacity in Ghana: From the 1850s to the 1990s

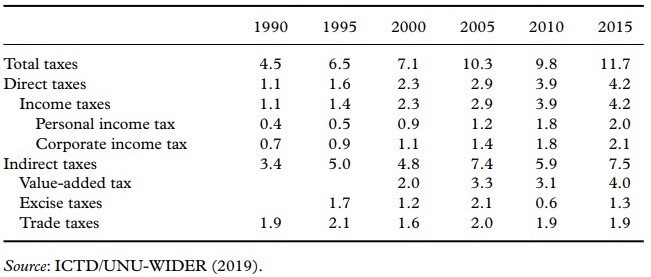

Ghana has recorded impressive annual GDP growth rates in recent years, averaging 7.2 percent between 2000 and 2013. However, Ghana’s total tax revenue as a share of GDP has remained modest in both global and regional perspectives. While it increased from 4.52 percent in 1990 to 12.38 percent in 2016, it was still below SSA’s average of 15.47 percent. Ghana depends largely on indirect taxes for much of its tax revenues (Table 1). Tax revenues have often been less than budgetary estimates and the country has consistently experienced fiscal imbalances.

Table 1: Ghana’s total tax revenue by component, share of GDP, 1990-2015

We show that Ghana’s weak fiscal capacity has a long history, and it is caused by the state’s consistent inability to meet its parts of the fiscal bargain. Our discussion focuses on four major tax reforms in Ghana between 1852 and 1998.

Poll tax, 1852-1861

The poll tax was the first attempt by the colonial administration to introduce direct taxation in Ghana (then the Gold Coast). In April 1852, the colonial administration and the chiefs acting on behalf of their people negotiated a fiscal contract. The colonized people were to pay a poll tax in exchange for investments in education, health care, the judicial system, and the development of internal communications. However, revenues collected from the poll tax were not used for public investments as negotiated in the fiscal contract. In the 1852-3 fiscal year, £6,656 were collected from the poll tax. Only £45 was spent on schools and £470 on roads. The remainder was used to pay the salaries of colonial officials and some chiefs’ stipends. Further, chiefs were not consulted in the expenditure of the realized revenues. The collection of the tax ceased in April 1861 after violent protests.

Income tax, 1931-1944

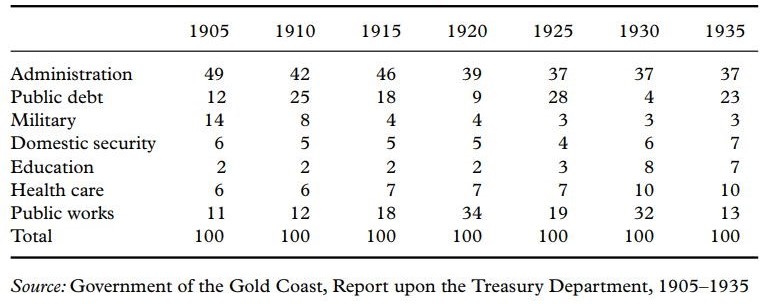

The colonial administration relied on import and export duties after the failed poll tax. Between 1927 and 1930-31, the Gold Coast’s fiscal position weakened because of the collapse of the world cocoa market due to the Great Depression. In September 1931, the colonial government announced its intention to introduce an income tax. African members of the Legislative Council, chiefs, commoners, some European merchants and the educated elite opposed the proposed Income Tax bill. This was not surprising, considering that the colonial government did not have a record of investing in public goods that met the needs of its subjects. As seen in Table 2, between 1905 and 1935, administrative expenditures accounted for between 37 and 50 percent of total, while health and education expenditures were less than 10 percent.

Table 2: Colonial government expenditure (percentage shares), 1905-1935

Further, unequal representation in the colonial administration undermined the legitimacy of the tax bargaining process. There was no African representation on the Executive Council and the 30-member Legislative Council had only nine African unofficial members. As a result of protests, riots, work stoppages and boycotts, the colonial state abandoned the Income Tax bill. In 1943, an Income Tax Ordinance was finally passed after reforms in the colonial administration allowed for more African representation.

Cocoa taxation, compulsory savings and sales tax, 1951-1966

In 1951, when Ghana became self-governing, the new nationalist leader Kwame Nkrumah and his Convention People’s Party (CPP) argued that although taxes would be levied, unlike the colonial administration’s, this taxation would bring economic rewards for everyone. To sustain revenues for its rising expenditure while world market cocoa prices declined, the government reformed the country’s tax system. Between 1960 and 1966, the government introduced several taxes, which led to a rise in the tax-to-GDP ratio from less than 11 percent in 1960 to about 16 percent in 1965. However, because the government increased its tax capacity by using coercion and curbed political opposition, the process of taxation lacked legitimacy. The use of force proved unsustainable in the long run. As Nkrumah’s government failed to meet the needs of the people, it was removed from office in February 1966.

Value-added tax (VAT), 1995-1998

In March 1995, the government introduced VAT as part of an IMF and World Bank supported Economic Recovery Programme to make taxation more equitable. Barely three months after its introduction, VAT was withdrawn after demonstrations that resulted in 16 casualties. VAT failed because the processes that led to its introduction were perceived as illegitimate as several interest groups were not consulted and there were no opposition parties in Parliament where discussions on VAT were mostly held. Opposition parties had boycotted the 1992 parliamentary elections for alleged rigging and irregularities in the presidential elections. Many Ghanaians also opposed VAT because of alleged inefficiencies, corruption, and wastefulness in government expenditure. In March 1998, a new VAT law was passed, this time after extensive consensus building and bargaining for a legitimate fiscal contract.

Conclusion

We point to the importance of reciprocity and fiscal contracts between the government and the governed as the foundation for effective taxation. While existing research has emphasized that the low fiscal capacity of African states is a result of colonial legacies of weak legal and tax systems, an equally important determinant is the inability of states to fulfill their side of the fiscal contract. Overcoming resistance to tax reforms therefore requires an understanding of the nature of political contestation over taxation and citizens’ perceptions of their governments over the long term.

References

Aboagye, P. Y., & Hillbom, E. (2020). Tax bargaining, fiscal contracts, and fiscal capacity in Ghana: A long-term perspective. African Affairs, 119(475), 177-202.

Burgess, R., & Stern, N. (1993). Taxation and Development. Journal of Economic Literature, 31(2), 762-830.

ICTD/UNU-WIDER, Government revenue dataset, (2019), https://www.wider.unu.edu/project/government-revenue-dataset (20 November 2019).

Levi, M. (1988). Of rule and revenue. University of California Press.

Mkandawire, T. (2010). On tax efforts and colonial heritage in Africa. The Journal of Development Studies, 46(10), 1647-1669.

Prichard, W. (2015). Taxation, responsiveness and accountability in Sub-Saharan Africa: the dynamics of tax bargaining. Cambridge University Press.

Feature image: “The Gold Coast Legislative Council in session, presided over by the Speaker.”, January 1957. The National Archives UK, CO 1069-53-76.