Economic development requires a state that can provide basic public goods to support the operation of markets, including courts of law and infrastructure. It therefore seems natural to blame the apparently sluggish pace of development in much of Africa over the past century on weak and fragile states (Herbst, 2000; Besley and Persson, 2014). Surely weak institutions imply a low ability to collect taxes, which in turn acts as a brake on development? While this narrative has increasingly been questioned by detailed historical work on tax collection in Africa (Frankema and Waijenburg, 2014; Gardner, 2012; Cogneau et al, 2021), it has essentially remained a fixed point in policy debates.

The Devil’s in the Detail: Measuring Taxes

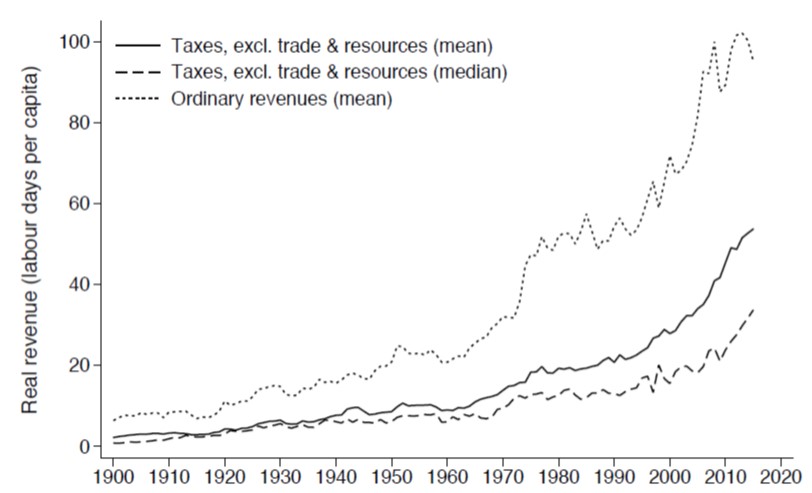

We are now in a position to provide an answer, having assembled a comprehensive new data set on central government revenues for most polities on the continent from colonization to the present day (Albers, Jerven and Suesse, 2023). We have collected data in French, Italian, Portuguese, British and German colonial archives, as well as from national statistical abstracts and previously classified IMF reports for the post-colonial period. We have also devised a new way of expressing revenues in comparable terms across time and space. The common summary statistic is to express government revenue as a share of GDP. This is problematic, given that GDP is mismeasured in post-colonial times, and there are very few estimates of GDP for the colonial period. We have therefore collected annual urban unskilled wages for all polities. By dividing revenue per capita by the daily wage, we get a readily interpretable measure of real revenue, expressed in labour days per capita (Figure 1).

Figure 1. Real revenue, labour days per capita, entire African sample, 1900-2015

Slouching towards Growth

These new data show that African polities have rapidly expanded their revenue base since independence. We obtain a similar picture if we exclude taxes that are easy to collect, such as trade and resource taxes. This is especially remarkable given that the remaining taxes, such as income and value-added taxes, require an elaborate institutional arrangement for collection. Apparently, governments in Africa have, notwithstanding popular conceptions to the contrary, at times invested heavily in such institutions.

Some of this expansion in direct taxation happened during colonial times, especially when there was insufficient trade to be taxed (for example, during the World Wars). Conversely, when alternative finance was available through aid and credit in the decade following World War II, direct tax revenue was lower than in periods when external sources of finance were scarce. Much of the increase in taxation, however, occurred after the end of colonization. The waves of democratization in the 1960s and 2000s coincide with high rates of growth in tax revenue, whereas the reverse is true for the period of instability in the 1980s.

A Revenue Divergence within Africa

There is, of course, a lot more that can be done with this data. It also allows us to compare individual country paths. Such a comparison shows that more democratic African countries have historically been better at collecting revenues than their more autocratic peers. This is especially the case if they were also free from ethnic divisions. There is, however, a caveat: the results also show that frequent changes in government tend to reduce tax collection. In other words, unstable democracies don’t necessarily outperform their autocratic counterparts.

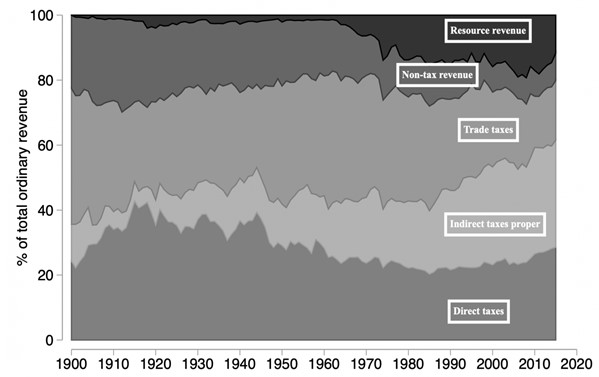

Finally, we are also able to use our data to refute another popular narrative. It is commonly believed that the presence of easily exploitable resource revenues has hindered the development of a non-resource tax base in African states. Why would a government tax its population when it can raise revenue from oil, gold or diamond extraction? At a first glance, our aggregate data do indeed suggest that, as a share of total revenues, direct tax receipts dwindled as resource revenues boomed after independence (see Figure 2).

Figure 2. Revenue categories as a share of total revenue, entire African sample

However, this pattern is misleading for two reasons. First, it does not consider the absolute level of taxes. Second, it only presents a correlation. Once we leverage exogenous changes in resource revenues driven by price shocks on world commodity markets, we find little evidence that large profits in the resource sector depress the real collection of direct taxes. This is in line with evidence from case studies. Many historically resource-dependent countries, such as Botswana and South Africa, are now among the top tax collectors on the continent (Gwaindepi and Siebrits, 2020). In fact, the (successful) management of resource receipts itself requires sophisticated institutions. Such institutions may help in the collection of both resource revenues and direct taxes.

References

Besley, Timothy and Torsten Persson (2014). Why do developing countries tax so little? Journal of Economic Perspectives 28(4), 99–120.

Cogneau, Denis, Yannick Dupraz, and Sandrine Mesplé-Somps (2021). Fiscal capacity and dualism in colonial states : The French Empire 1830-1962. Journal of Economic History 81(2), pp. 441-480

Frankema, Ewout and Marlous van Waijenburg (2014). Metropolitan blueprints of colonial taxation? Lessons from fiscal capacity building in British and French Africa, c. 1880-1940. The Journal of African History 55(3), 371–400.

Gardner, Leigh (2012). Taxing colonial Africa: The political economy of British imperialism. Oxford University Press, Oxford.

Gwaindepi, Abel and Krige Siebrits (2020). How mineral discoveries shaped the fiscal system of South Africa. In Ewout Frankema and Anne Booth (Eds.), Fiscal capacity and the colonial state in Asia and Africa, c.1850-1960, Chapter 9, pp. 264–298. Cambridge University Press, Cambridge.

Herbst, Jeffrey (2000). States and power in Africa: Comparative lessons in authority and control. Princeton Studies in International History and Politics. Princeton University Press, Princeton and Oxford.

Feature image: Ghana Supreme Court Accra, by aripeskoe2, Wikimedia.